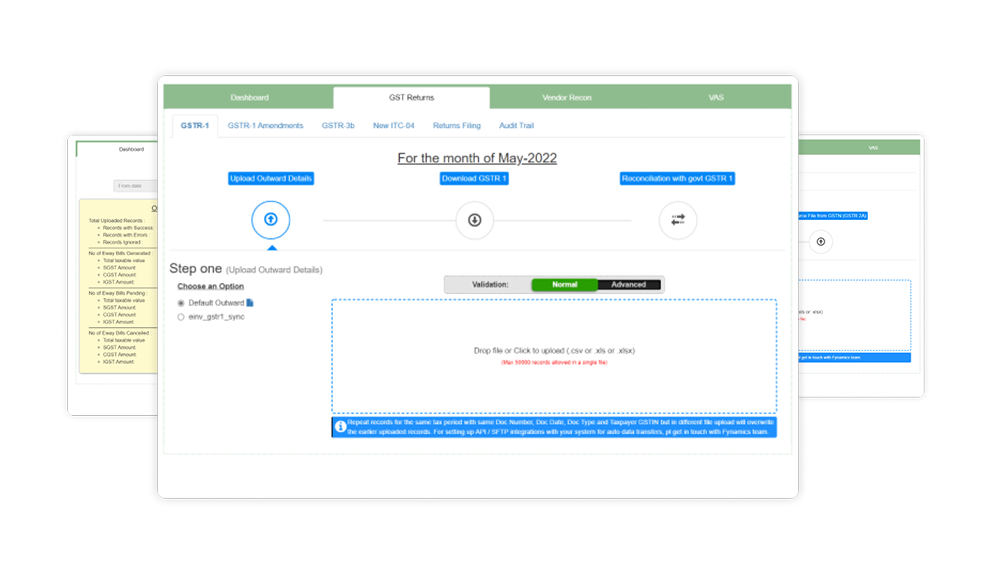

E-Invoicing

A billing application which allows customers to raise invoices on an automated basis and integrates with various accounting packages or ERPs for accurate and complete financial accounting. Our billing solution offers value in the form of:

- End to end automated invoicing

- 50+ input validations

- ERP/Accounting package agnostic for seamless integration

- Also available on Google Play Store for ease of mobility

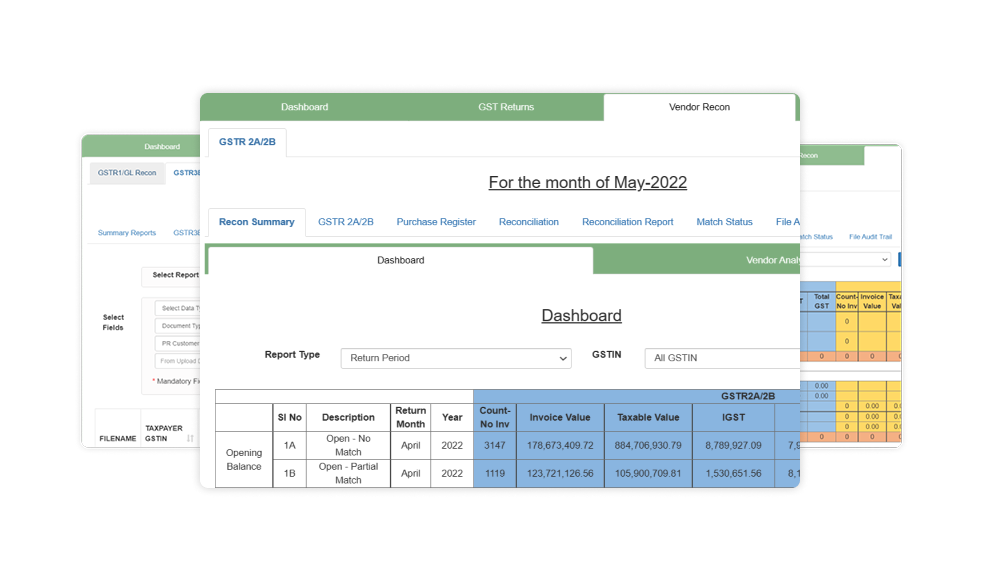

Reconciliations

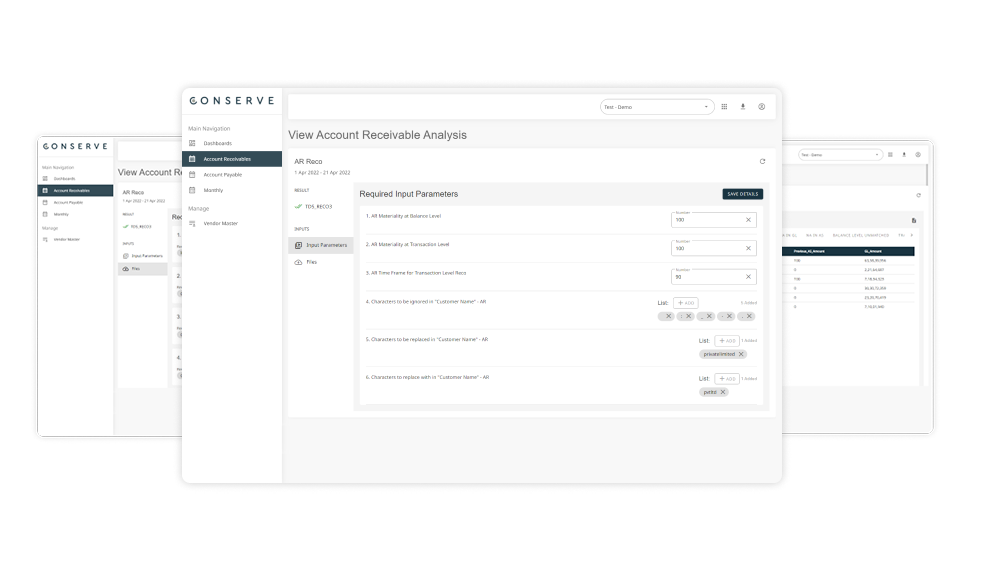

Solution offers reconciliation functionalities between books of accounts (General ledger) and Einvoice + Eway bill data on the sales side or purchases/expenses with 3B or Eway bill. Customise and choose reconciliation parameters that best suit your business and also discover unmatched records for timely remediations. Key features offered are:

- Integrated reconciliations with any ERP system via API or SFTP

- Customize reconciliation parameters

- Fuzzy logic for near match suggestions

Indirect Taxes – Goods and Service Tax (‘GST’) Compliance

Fynamics, a comprehensive GST solution which includes various reconciliation controls required along with a seamless return filing capability. This tool has inbuilt validations, check points and can even allow customers to exercise controls over the process by designating suitable roles and responsibilities against each function. Key value additions which accrues to you as a customer:

- Full stack GST compliance (including services)

- Holistic solutions whether problems are data based or positions based

- Customisable input configuration for seamless integration into your accounting systems

Direct Taxes – Withholding Tax

A one stop solution for customers grappling with complexities arising from withholding tax compliances in India. The tool has been built to allow users to obtain assurance over accuracy and completeness of underlying data, resulting in convenience over withholding tax compliance. Enjoy the following benefits from this solution:

- Arrest cash leakages in the form of TDS credit lapses

- Identify and mitigate potential disallowances arising out of withholding tax

- Input data can be customised and configured to suit customer needs

Direct taxes

Whether it’s compliance or advisory all matters relating to Income tax can be addressed by our professional tax experts. Our experts have the wherewithal to actively engage and advise on all strategic, transaction and compliance related requirements in relation to direct taxes. The key advantages of our direct tax solutioning are:

- A 360 degree holistic solutioning on all direct tax requirements

- Access to in depth knowledge and database including matters on international taxation