Over the last decade, there have been substantial advancements in transaction matching tools, particularly when combined with intelligent routines or rules.

At Consark, we have focused on creating a customizable transaction matching routine that enables users to establish reconciling rules personalized to their specific accounting practices. This adaptability is crucial, especially in the complex process of inter-company reconciliation, which becomes even more challenging when preparing consolidated financial statements under Generally Accepted Accounting Principles (GAAP).

The complexities of inter-company reconciliation

Inter-company reconciliation is notoriously time-consuming, and several factors contribute to its complexity. Understanding these challenges is key to appreciating the capabilities required in any effective transaction matching tool.

- Regulatory Deductions: International transactions, especially those between entities in different countries, are often subject to taxes and regulatory deductions. These variations can complicate reconciliation, requiring tools that can adapt to diverse regulatory environments.

- Foreign Exchange Differences: With subsidiaries operating in multiple currencies, foreign exchange differences can add layers of complexity to inter-company reconciliations. Transactions recorded in functional currencies need careful matching to ensure accuracy in consolidated financial statements.

- Multiple GAAP Books: Multiple group companies may be accounting for transactions to comply with local GAAP requirements, leading to variations in how transactions are recorded. Reconciling these differences to produce a unified financial statement requires sophisticated tools capable of handling multiple accounting standards.

The illustrations listed above are only indicative and not exclusive, but they have been detailed above primarily to give a sense of the capabilities required in any transaction matching tool which can help users tide over these complexities.

Rule-based transaction matching automation

At Consark, we’ve recognized that while generic rules can serve as a starting point, the true value of a transaction matching tool lies in its ability to adapt to the unique needs of each user. Without customization, the tool might fall short of delivering the efficiencies it promises, leaving users to spend just as much time resolving discrepancies manually.

Inter-company reconciliations with Consark

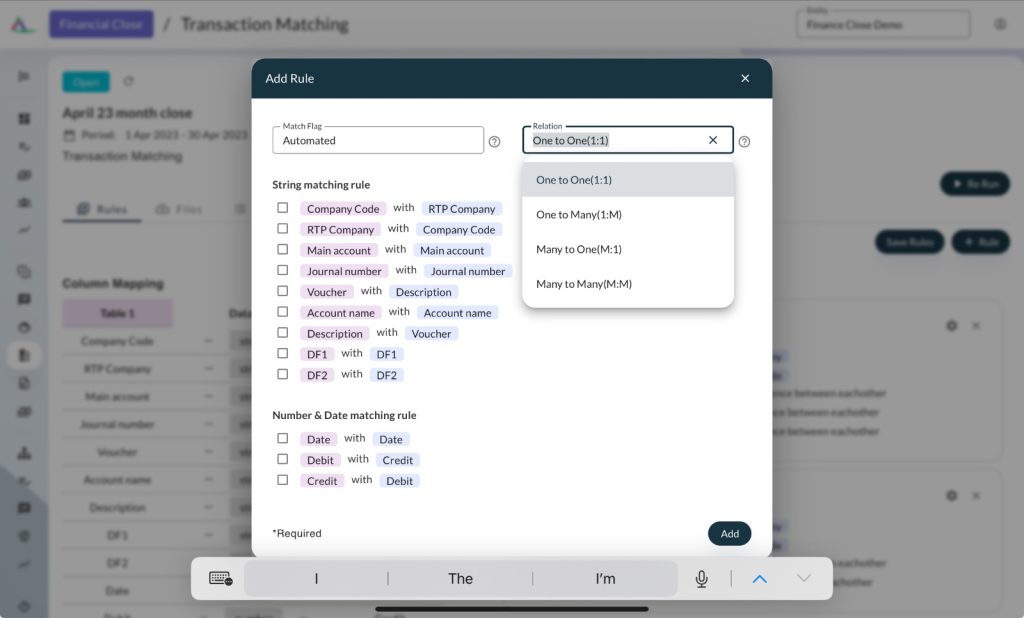

To address this, we’ve designed our reconciliation routines around four primary categories:

- One-to-One: Matching a single transaction to another single transaction.

- One-to-Many: Reconciling one transaction against multiple corresponding entries.

- Many-to-One: Matching multiple transactions against a single entry.

- Many-to-Many: Comparing and reconciling multiple transactions across two ledgers.

This allows users to house the rules under any of the 4 buckets so that users can compare and reconcile any two ledgers appropriately. Multiple sets of reconciling rules can be defined for each type of reconciliation, and all this driven by the user themselves.

Empowering finance teams with intelligent transaction matching

Consark’s transaction matching tool empowers finance teams to create and modify rules tailored to specific accounting practices. This customization saves time, reduces errors, and enhances reconciliation efficiency. With Consark’s flexible transaction matching routines, teams can confidently handle complex reconciliations, driving flawless outcomes across the organization.