Noa AI That Aligns Transactions Before the Close Begins.

High-volume transaction matching is prepared continuously using a next-generation matching engine, so alignment happens before close pressure begins.

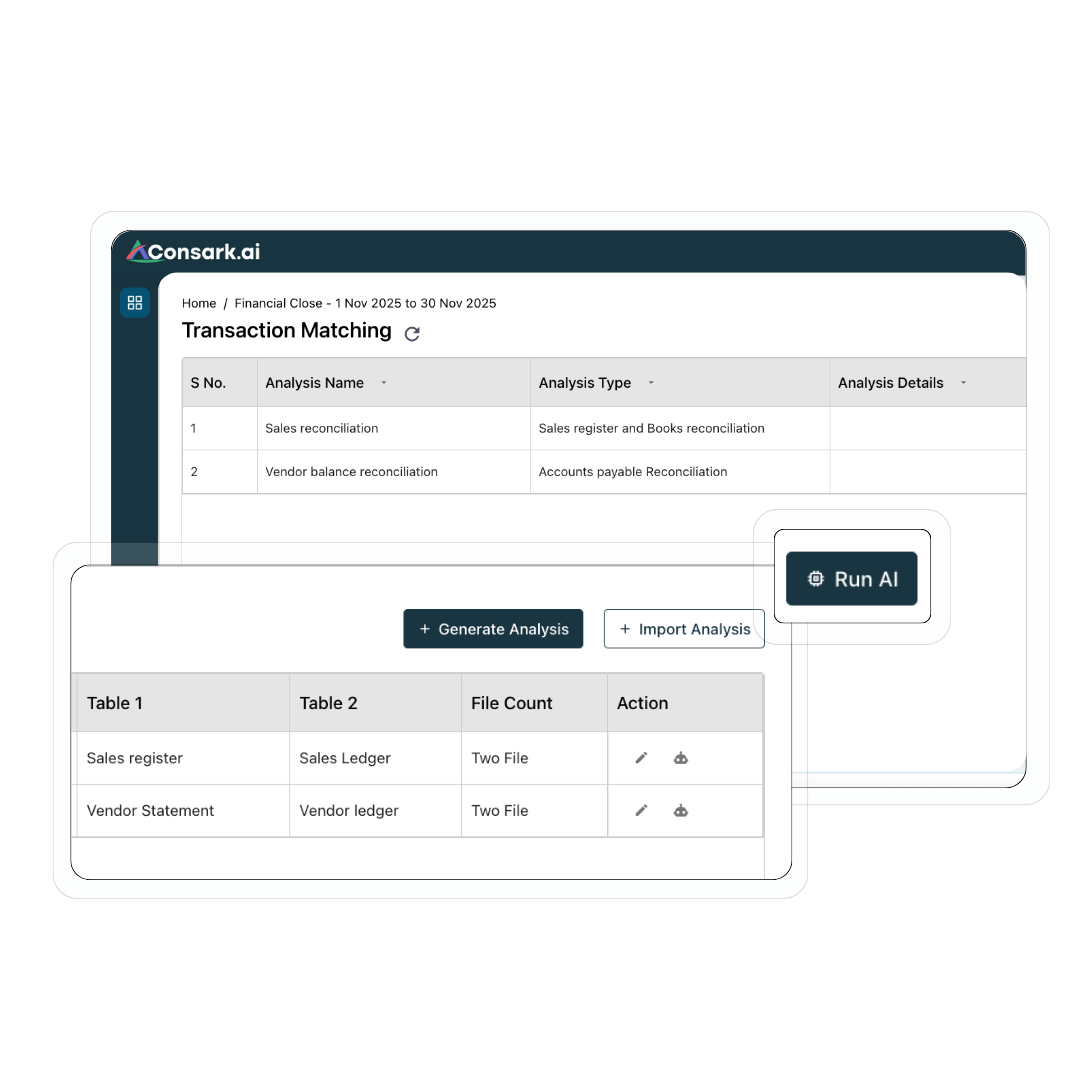

How Noa AI Agents Execute Transaction Matching.

Accounting Logic, Applied Consistently at Scale

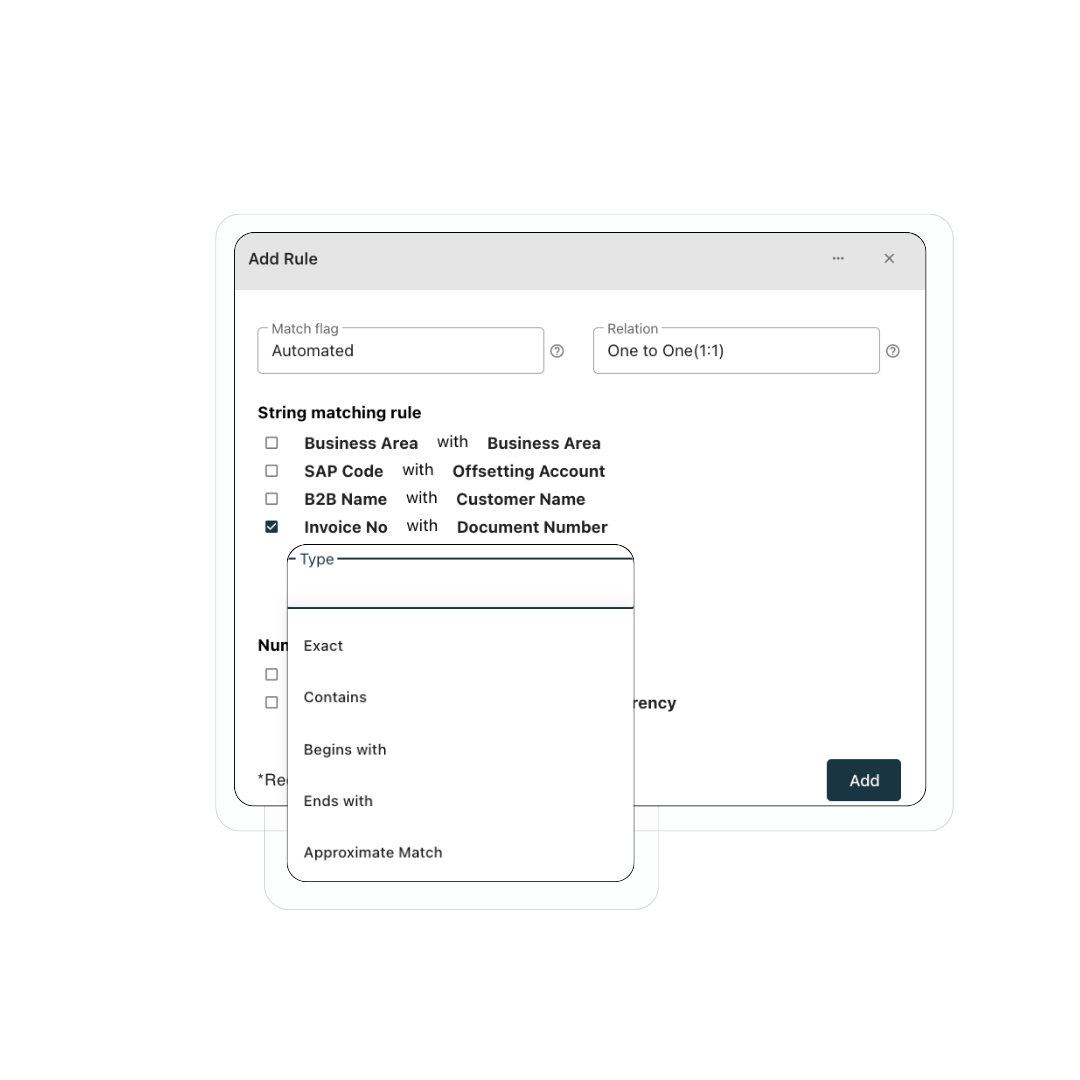

Matching rules are defined once and applied every period. Support one-to-one, one-to-many, and many-to-many scenarios. Execution stays consistent across entities and volumes.

Intelligence Built for Unstructured, Real-World Data.

Noa Agents go beyond rigid rules to resolve real-world accounting data.

• Fuzzy matching handles inconsistent descriptions and references.

• Pattern recognition identifies related transactions across sources.

• Partial matches, timing differences, and data irregularities are supported.

• 35% reduction in manual investigation.

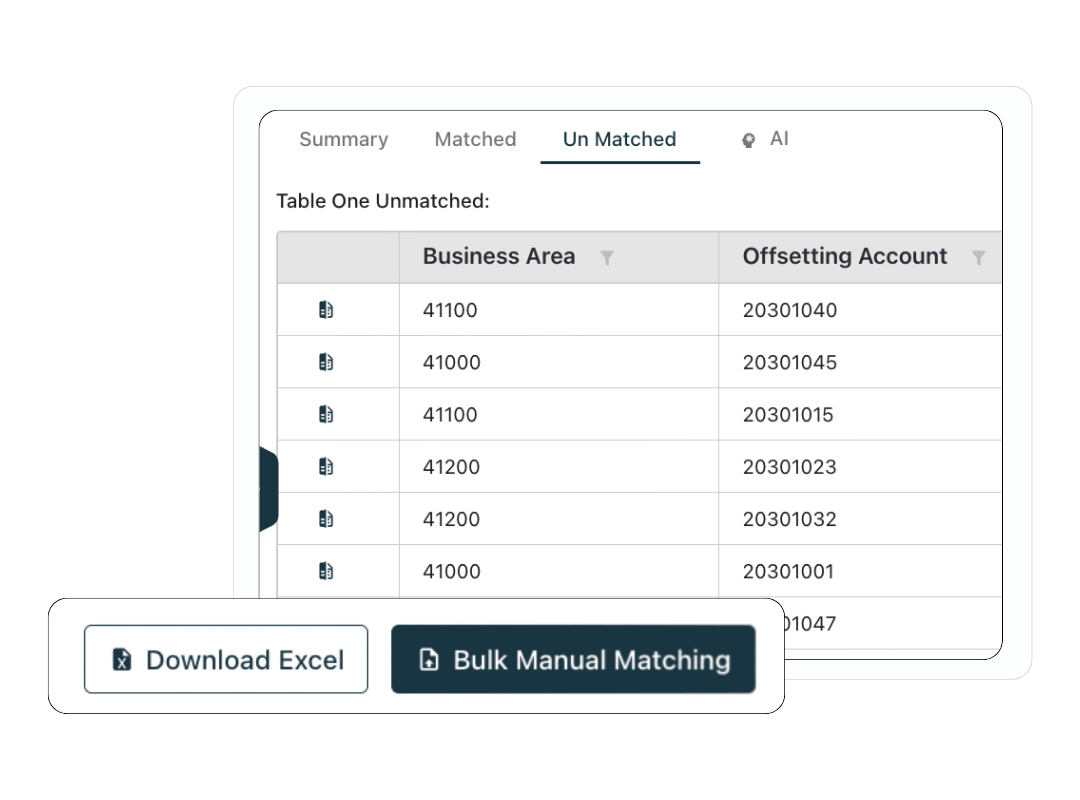

Exceptions Arrive Ready for Judgment.

Only what requires professional review rises to the surface.

• Policy-driven thresholds automatically clear immaterial activity.

• Unmatched and partial matches clearly flagged.

• Each exception includes context, source data, and rationale.

• Review effort is focused and not fragmented.

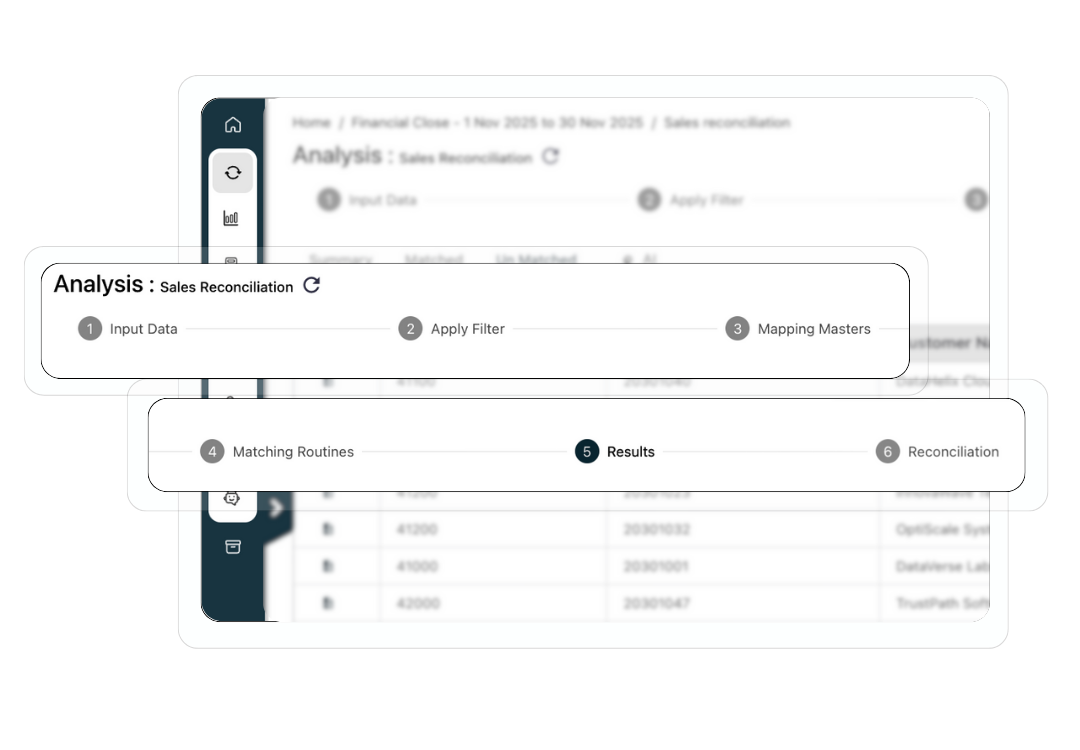

Continuous Matching That Directly Powers the Close.

Transaction matching operates as part of close execution, not as a standalone activity.

• Matching outcomes flow directly into account reconciliations.

• Aligned transactions reduce downstream variance analysis.

• Parallel investigation across tools and spreadsheets eliminated.

• Close preparation accelerates as matching completes.

Faster Approvals with Full Clarity.

Every match remains explainable and audit-ready.

• Clear lineage from source transaction to matched outcome.

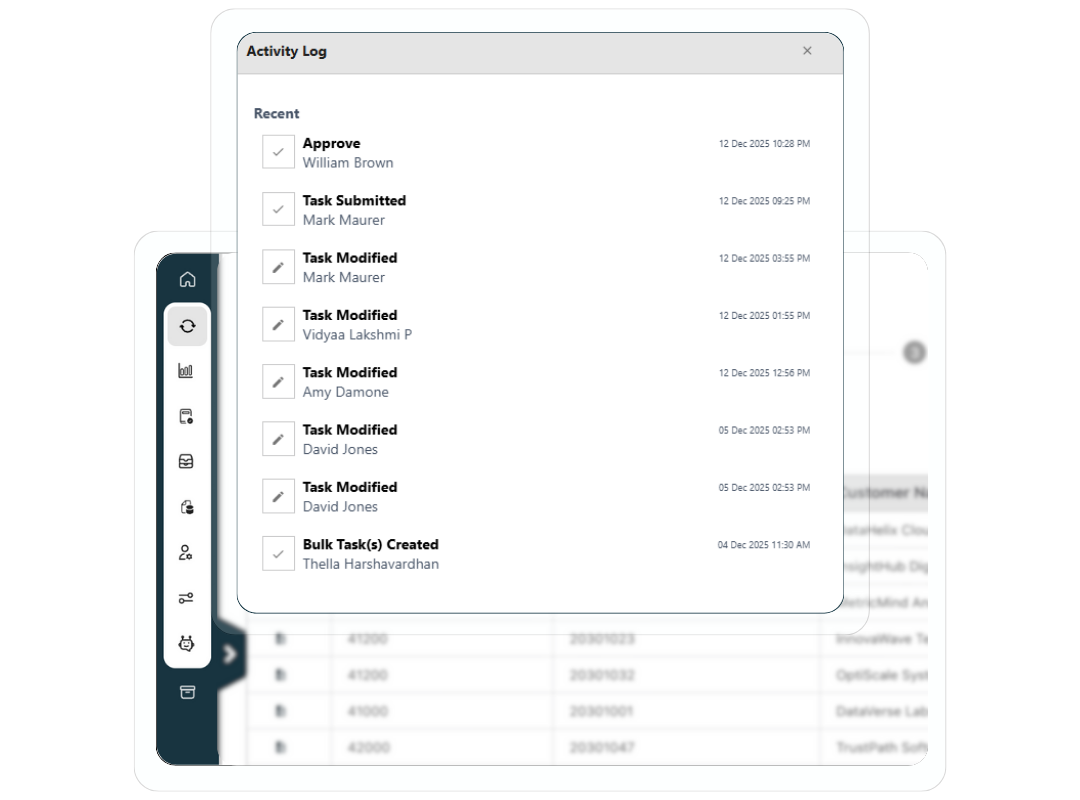

• Reviewer actions, comments, and approvals preserved.

• Supporting evidence retained alongside results.

• Audit readiness is built in and not reconstructed later.

What Finance Teams Are Seeing in Practice

Transaction Matching That Reduces Risk with Confidence.

Free your team from manual matching, without losing control.

Platform

Noa

Solution by industry

Why Consark

2013-2026 Consark.ai Inc | Privacy Policy | Terms of use